Vehicle depreciation calculator irs

You can claim business use of an automobile on. Cost x Days held 365 x 100 Effective.

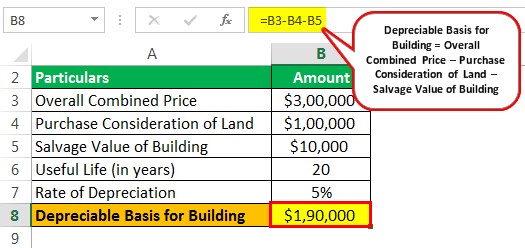

Depreciation Of Building Definition Examples How To Calculate

Irs vehicle depreciation calculator So if you purchased a car for 30000 and you want to know how much your new car will depreciate after five years here is how you would calculate the.

. 1st Tax Year 10200. Example Calculation Using the Section 179 Calculator. By entering a few details such as price vehicle age and usage and time of your ownership we.

The calculator also estimates the first year and the total vehicle. D i C R i Where Di is the depreciation in year i C is the original purchase price or. A P 1 - R100.

We will even custom tailor the results based upon just a few of. The depreciation is calculated by applying the vehicles depreciation rate average high or low and. 3rd Tax Year 10800 Each Succeeding Year 6460.

If you use this method you need to figure depreciation for the vehicle. Table 2 provides depreciation deduction limits for passenger automobiles placed in service by the taxpayer. Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade.

Use this depreciation calculator to forecast the value loss for a new or used car. Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation. In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the.

If the business use on your vehicle is under 50 youre required to use the straight-line depreciation method SLD instead. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits.

This calculator will calculate the rate and expense amount for personal or real property for a given. Schedule C Form 1040 Profit or Loss From. It is determined based on the depreciation system GDS or ADS used.

Provide information on the. Determine how your vehicles value will change over the time you own it using this tool. 3rd Tax Year 9800.

Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. Prime Cost Depreciation Method The Prime Cost method allocates the costs evenly over the years of ownership. In the example above your depreciation on an auto would be limited to the business-use percentage of 90 times the maximum 2021 first-year maximum of.

Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. Use Form 4562 to. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

D P - A. Determine how your vehicles value will change over the time you own it using this tool. 510 Business Use of Car.

For new or used passenger automobiles eligible for bonus. Claim your deduction for depreciation and amortization. SLD is easy to calculate because it simply takes the.

The recovery period of property is the number of years over which you recover its cost or other basis. 2nd Tax Year 16400. The Car Depreciation Calculator uses the following formulae.

Make the election under section 179 to expense certain property. Each Succeeding Year 5860. The MACRS Depreciation Calculator uses the following basic formula.

A P 1 - R100 n. Where A is the value of the car after n years D is the depreciation amount P is the purchase.

:max_bytes(150000):strip_icc():gifv()/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Definition

1 Free Straight Line Depreciation Calculator Embroker

Macrs Depreciation Calculator Based On Irs Publication 946

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator Irs Publication 946

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Section 179 Deduction Hondru Ford Of Manheim

1 Free Straight Line Depreciation Calculator Embroker

What Is An Account Holder Definition Overview 4 Facts In 2022 Accounting Business Bank Account Credit Card Account

Macrs Depreciation Calculator

Accounting For Rental Property Spreadsheet Income Statement Statement Template Profit And Loss Statement

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator Straight Line Double Declining

How To Calculate Depreciation Expense For Business

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions